Silver bars represent one of the purest, most straightforward ways to enter precious metals investing. Unlike coins with collectible premiums or complex financial instruments, silver bars are valued primarily for their metal content: making them perfect for beginners who want direct exposure to silver's price movements without paying extra for numismatic value.

If you're considering your first precious metals investment, silver bars offer an accessible entry point that combines affordability with the security of physical ownership. Let's break down everything you need to know to make an informed decision.

What Exactly Are Silver Bars?

Silver bars are solid blocks of refined silver, typically cast or minted into standardized shapes and weights. They're essentially silver in its most basic, utilitarian form: no fancy designs, historical significance, or collector appeal. Just pure metal that moves with the market.

The key characteristics that define quality silver bars:

- Purity: Usually 99.9% pure silver (marked as "999 fine")

- Weight: Clearly stamped and verified

- Hallmarks: Manufacturer's mark and purity certification

- Serial numbers: For tracking and authenticity verification

This simplicity is actually silver bars' greatest strength. You're buying metal, not stories or artwork, which means you pay closer to the actual silver spot price.

Why Silver Bars Make Sense for New Investors

Affordability Opens Doors

Silver trades at roughly 1/80th the price of gold, making it accessible for investors with smaller budgets. While a single ounce of gold might cost $2,000+, you can own an ounce of silver for under $30. This low barrier to entry lets you test precious metals investing without major financial commitment.

Industrial Demand Provides Foundation

Unlike gold, which is primarily used for jewelry and investment, silver has massive industrial applications. It's essential in electronics, solar panels, medical devices, and water purification systems. This industrial demand creates a price floor that pure investment metals sometimes lack.

Inflation Protection That Actually Works

When currency loses purchasing power, physical assets like silver typically maintain or increase their value. Silver has served as a store of wealth for over 4,000 years: a track record no paper currency can match.

Portfolio Diversification Made Simple

Adding silver to a portfolio of stocks and bonds provides diversification that often moves independently of traditional markets. During economic uncertainty, precious metals frequently perform well when other assets struggle.

Understanding Silver Purity and Specifications

The 999 Standard

Most investment-grade silver bars contain 99.9% pure silver, marked as "999 fine." This purity level ensures you're getting genuine investment-grade metal rather than sterling silver (92.5% pure) used in jewelry.

Weight Accuracy Matters

Reputable bars are precisely weighed and stamped. A 10 oz bar should contain exactly 10 troy ounces of silver (approximately 311 grams). Any significant deviation indicates either poor manufacturing or potential counterfeiting.

Hallmarks and Certifications

Legitimate bars display:

- Manufacturer's name or logo

- Weight in troy ounces

- Purity marking (999 or .999)

- Serial number (on larger bars)

These markings aren't just decoration: they're your guarantee of authenticity and quality.

Choosing the Right Size for Your Needs

1 oz Bars: Perfect for Beginners

Single-ounce bars offer maximum flexibility. They're easy to authenticate, simple to store, and provide liquidity: you can sell individual ounces rather than entire positions. The premium over spot price is higher per ounce, but the convenience often justifies the cost.

10 oz Bars: The Sweet Spot

Ten-ounce bars represent the optimal balance for most investors. They offer significantly lower premiums than smaller bars while remaining manageable for storage and sale. Most dealers stock 10 oz bars extensively, ensuring good liquidity.

100 oz Bars: For Serious Accumulation

Large bars provide the lowest premiums per ounce: sometimes just $0.50-1.00 over spot price. However, they require more storage space and can be harder to sell quickly. Consider these only if you're investing $5,000+ and plan to hold long-term.

Fractional Options: 1 Gram to 1 oz

For those testing the waters or working with very limited budgets, small fractional bars exist. While premiums are high, they let you own physical silver with minimal initial investment.

Popular Silver Bar Brands You Should Know

Elemetal Mint

Elemetal produces high-quality bars with distinctive packaging and security features. Their bars often carry slightly higher premiums but offer excellent resale value due to brand recognition. Look for their signature holographic security labels.

APMEX (American Precious Metals Exchange)

APMEX-branded bars are widely recognized and trusted. They offer various sizes with competitive premiums and excellent liquidity in the secondary market. Their bars often feature clean, professional designs that appeal to both investors and collectors.

NTR Metals

NTR Metals produces cost-effective bars popular among budget-conscious investors. While they may carry slightly lower premiums, they maintain good liquidity and quality standards. These bars focus on metal content rather than aesthetics.

Other Notable Brands:

- Sunshine Minting: Known for innovative anti-counterfeiting technology

- Johnson Matthey: Premium British refiner with excellent reputation

- Engelhard: Vintage bars highly sought after by collectors

How to Choose Your First Silver Bars

Start With Your Budget

Determine how much you're comfortable investing initially. Remember, precious metals should typically represent 5-10% of your total investment portfolio, not your entire financial strategy.

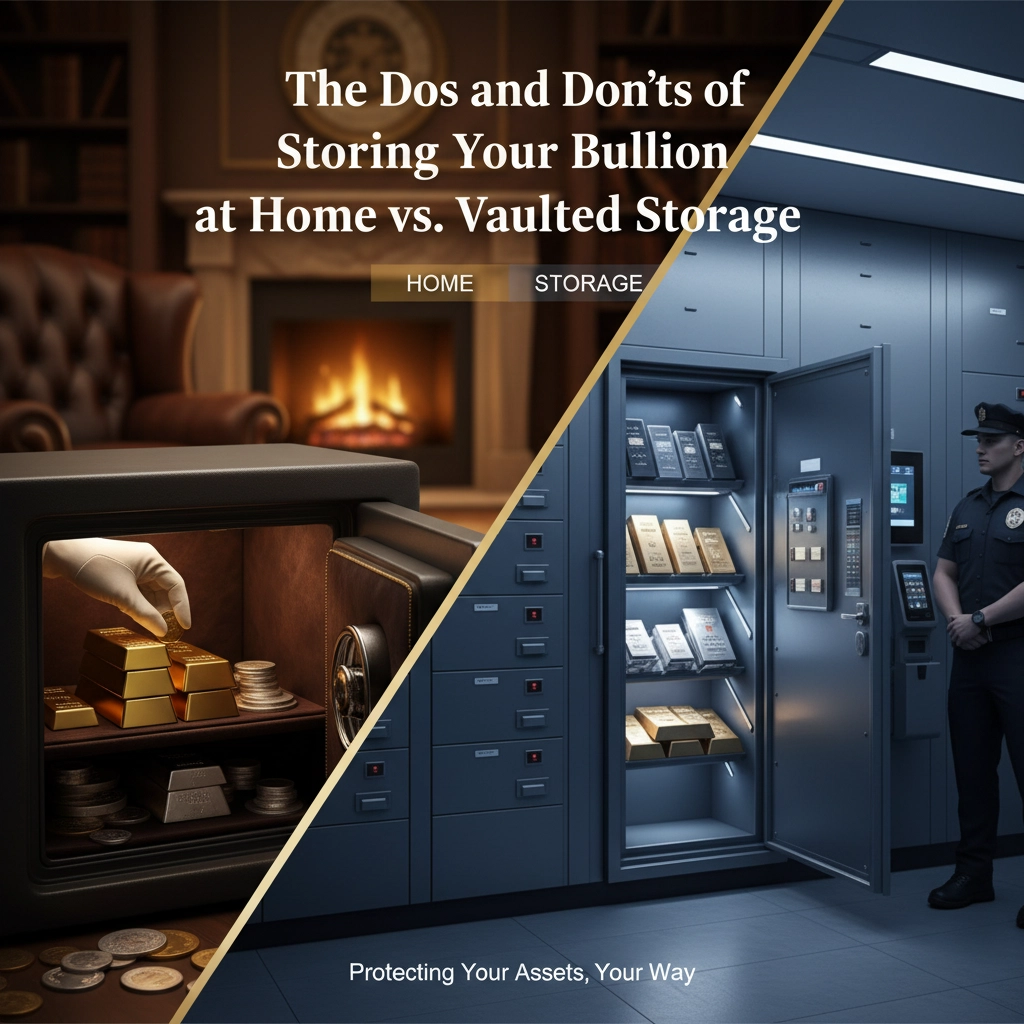

Consider Your Storage Situation

Larger bars require secure storage solutions. If you're keeping metals at home, smaller bars offer more flexibility. If using professional storage, larger bars maximize your storage efficiency.

Think About Your Timeline

Planning to hold for decades? Large bars minimize premiums. Want flexibility to sell portions over time? Smaller denominations make more sense.

Factor in Liquidity Needs

Popular brands and standard sizes (1, 5, 10, 100 oz) sell more easily than unusual weights or obscure manufacturers. Stick with recognized names for your first purchases.

Where and How to Buy Silver Bars

Authorized Dealers vs. Online Marketplaces

Stick with established precious metals dealers rather than auction sites or classified ads for your first purchases. Reputable dealers offer:

- Guaranteed authenticity

- Competitive pricing

- Secure shipping

- Customer service

- Return policies

Understanding Premiums

The premium is the amount you pay above the silver spot price. Typical premiums range from:

- Large bars (100+ oz): $0.50-2.00 per ounce

- Medium bars (10 oz): $1.00-3.00 per ounce

- Small bars (1 oz): $2.00-5.00 per ounce

Lower premiums mean more silver for your dollar, but consider storage and liquidity factors.

Payment Methods and Security

Most dealers accept:

- Bank wires (often lowest prices)

- Credit cards (convenient but higher fees)

- Personal checks (longer processing times)

Always verify secure website protocols (https://) and read customer reviews before making large purchases.

Storage and Security Considerations

Home Storage Options

For smaller amounts, a quality home safe provides convenient access. Ensure it's fireproof, waterproof, and securely anchored. Keep your metals storage confidential: don't advertise your holdings.

Professional Storage Solutions

Larger holdings benefit from professional storage facilities offering:

- Enhanced security systems

- Insurance coverage

- Segregated storage options

- Easy access for sales

Insurance Considerations

Standard homeowner's insurance may not cover precious metals adequately. Consider riders or specialized coverage for significant holdings.

Red Flags to Avoid

Too-Good-to-Be-True Pricing

Legitimate silver bars trade within narrow premium ranges. Deals significantly below market rates often indicate counterfeits or scams.

Unverified Sellers

Always research sellers thoroughly. Check Better Business Bureau ratings, online reviews, and industry certifications before making purchases.

Pressure Tactics

Reputable dealers don't use high-pressure sales tactics or artificial urgency. Take time to research and compare options.

Making Your Move: Next Steps

Silver bars offer an excellent entry point into precious metals investing. They're straightforward, affordable, and provide direct exposure to silver's price movements without complex fees or management requirements.

Your action plan:

- Determine your budget for precious metals allocation

- Choose appropriate bar sizes based on your needs

- Research reputable dealers in your area or online

- Compare current premiums across different brands and sizes

- Plan your storage solution before purchasing

- Start small and expand your holdings over time

Ready to add silver bars to your investment portfolio? Bullion Fortune specializes in helping new investors navigate their first precious metals purchases with confidence. Our experts provide personalized guidance on selection, pricing, and secure delivery: ensuring your investment arrives safely and meets your specific needs.

Contact Bullion Fortune today for professional consultation and access to competitive pricing on quality silver bars from trusted manufacturers. With our insured delivery and expert support, you can start building your precious metals position with complete peace of mind.

Don't let uncertainty erode your wealth: take control with the time-tested security of physical silver.

Leave a comment