What if the best time to invest in gold wasn’t 10 years ago… but right now?

If you’re sitting on the sidelines wondering whether you’ve missed the golden window—stop. The idea that “the ship has sailed” on gold investing in 2025 is not just wrong—it could cost you one of the most important financial opportunities of this decade.

Gold in 2025: This Isn’t a Peak. It’s a Signal

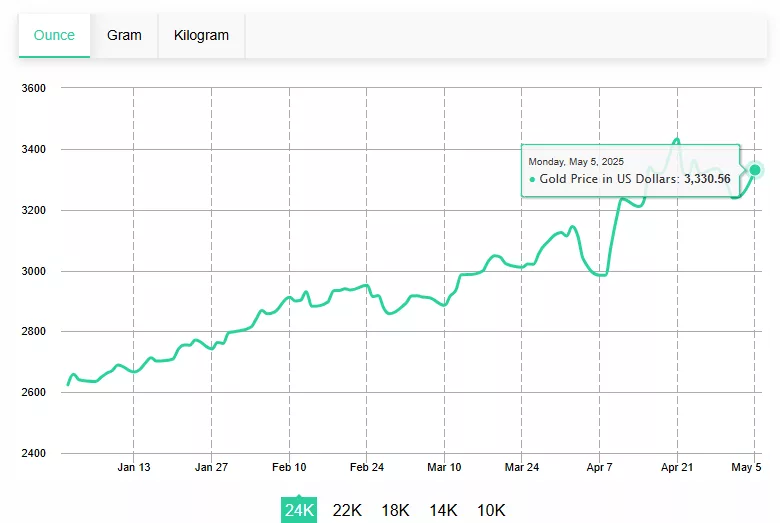

Gold recently surged past $3,350 per ounce, clocking in over 26% growth in just the first few months of 2025.

That’s not normal.

This isn’t the result of hype, social media trends, or speculative fever. It’s a flashing red light about where the global economy is heading.

| Key Factor | Insight |

|---|

| Central Banks Buying | China, Russia, and other major economies added record amounts of gold to their reserves. |

| Weaker USD | The U.S. dollar has steadily declined as interest rate hikes pause and fiscal uncertainty grows. |

| Recession Warnings | Analysts at JPMorgan and Goldman Sachs are projecting high odds of a recession around 45% within 12–18 months. |

| Inflation Risk | Sticky inflation in the 3–4% range has returned investor interest to gold as a long-term hedge. |

Why Smart Investors Aren’t Waiting

Imagine this: You walk into a high-end store and see gold priced at $3,357. Do you turn around and say, “Too late. I should’ve come when it was $2,000”?

Or do you ask: “Why is it this high now… and could it go even higher?”

The reality is this: gold doesn’t just reflect value—it reveals distrust.

Every time markets shake, every time inflation whispers, and every time global powers re-strategize their reserves… gold moves.

And right now, it’s moving fast. Bullion Fortune is the trusted place to contact bullion dealer and invest in the most trending gold coins such as Canadian Maple Leaf, American Eagle and more

How Has Gold Compared to Other Assets in 2025?

| Asset | Year-to-Date Return (2025) |

|---|---|

| Gold | ✅ +26.2% |

| S&P 500 | ❌ -3.8% |

| Bitcoin | ✅ +9.4% (with volatility) |

| Bonds (10Y) | ❌ Flat / Negative yields after inflation |

Gold isn’t just keeping up—it’s outperforming traditional “safe” assets. And unlike tech stocks or crypto, it doesn’t crash overnight.

Gold’s Performance in 2025

As of May 6, 2025, gold is trading at approximately $3,357.63 per ounce, marking a significant increase from the year’s low of $2,623.91 on January 1 . This upward trajectory is attributed to several key factors:

- Central Bank Purchases: In Q1 2025, central banks acquired 244 tonnes of gold, underscoring gold’s role as a strategic reserve asset amid geopolitical uncertainties .

- Geopolitical Tensions: Recent policy announcements, such as the U.S. imposing a 100% tariff on foreign films, have heightened market volatility, prompting investors to seek safe-haven assets like gold .

- Interest Rate Policies: The Federal Reserve’s decision to maintain interest rates between 4.25% and 4.50% has influenced gold’s appeal, as lower interest rates reduce the opportunity cost of holding non-yielding assets like gold .

Don’t Let the Price Fool You

Seeing gold’s current price and assuming it’s “too late” is like avoiding an expressway because the traffic is moving. Momentum matters.

The key question isn’t “Is gold expensive?”—it’s “Is my portfolio ready if things go south?”

Historically, gold has acted as a stabilizer during:

- Market crashes (2008, 2020)

- Currency devaluations

- Inflationary spikes

- Wars and geopolitical tension

Guess what 2025 is full of? All of the above.

What Should You Do Next?

Here’s a simple plan:

- Explore Your Options

Browse our gold bars & coins to find sizes and weights that suit your goals.

History shows that gold doesn’t reward panic—it rewards preparation.

If you’re wondering whether 2025 is too late to buy gold, remember this: timing markets is nearly impossible, but positioning yourself ahead of uncertainty is the real power move.

You haven’t missed the boat. You’re standing at the dock with a ticket in your hand.

FAQs

Yes. Despite high prices, gold continues to offer stability, especially during economic uncertainty and inflation.

Gold has outperformed many stocks and indices in 2025 and offers a non-correlated hedge to traditional markets.

Many financial advisors recommend 5–15% of your portfolio in precious metals, depending on your risk appetite.

If you’re contemplating whether you’ve missed the opportunity to invest in gold, consider this: gold prices have surged over 26% in 2025, reaching new highs and capturing investor attention worldwide. Visit Bullion Fortune today and invest in the gold bullions, silver bars and coins.

Leave a comment