We're living in an unprecedented era of technological change. Artificial intelligence is reshaping industries, automated trading systems control billions in assets, and digital currencies are challenging traditional finance. Yet paradoxically, one of humanity's oldest stores of value: gold: has never been more relevant.

Smart investors are discovering that in our hyperconnected, algorithm-driven world, precious metals offer something that no amount of code can replicate: true financial independence from digital systems. Let's explore how modern investors are using gold to hedge against AI and tech uncertainty while embracing digital tools to access this timeless asset.

The AI Uncertainty Problem

Here's something most people don't realize: AI systems can't predict what they've never seen before. During the COVID-19 pandemic, financial AI models across the globe failed spectacularly because no dataset had prepared them for such a global crisis. When unprecedented events occur, even the most sophisticated algorithms become unreliable.

This creates a fundamental problem for investors who rely heavily on AI-driven trading systems and tech stocks. When these systems break down: and they will: what's your backup plan?

Consider what happened during major tech selloffs in recent years. AI-powered trading algorithms amplified market volatility, creating sudden, dramatic price swings that caught even seasoned investors off guard. Meanwhile, gold often moved in the opposite direction, providing a steady anchor during the storm.

The key insight: While AI can help you make better investment decisions, it can also create new forms of systematic risk that didn't exist before. Gold serves as your insurance policy against these digital-age vulnerabilities.

Why Gold Still Matters in a Digital World

Unlike your favorite tech stock or cryptocurrency, gold doesn't need:

- Software updates

- Internet connectivity

- Server maintenance

- Bug fixes

- Security patches

Gold simply exists. It holds value regardless of whether the power grid is running, the internet is working, or AI systems are functioning properly.

But there's more to it than just being "analog." Gold has several unique characteristics that make it particularly valuable as a hedge against tech uncertainty:

Counter-Cyclical Performance: When tech stocks crash, gold often rises. This negative correlation provides natural portfolio balance that's especially important when your other investments are heavily weighted toward digital assets.

Inflation Protection: As central banks print money to fund tech infrastructure and digital transformations, gold maintains purchasing power over time. While your cash loses value to inflation, gold tends to keep pace or outperform.

Geopolitical Stability: In an era of cyber warfare and digital espionage, physical assets like gold remain immune to hacking, data breaches, and other digital threats.

Modern Ways to Access Gold

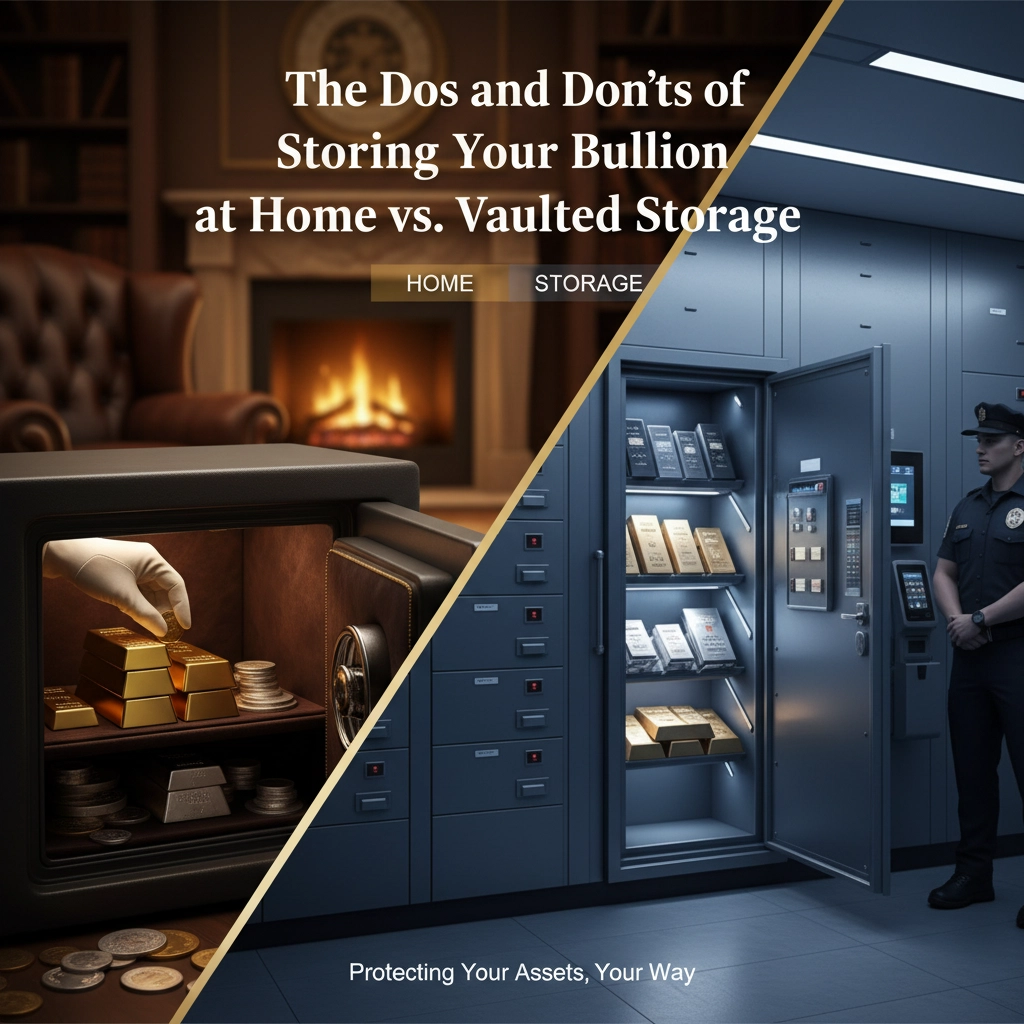

The beautiful irony of gold in the digital age is that technology has made it easier than ever to own precious metals. You no longer need to visit coin shops or worry about storage: modern platforms let you buy, sell, and store gold with a few taps on your smartphone.

Digital Gold Platforms

Today's digital gold platforms offer unprecedented convenience:

- 24/7 Trading: Unlike traditional markets, you can buy or sell gold anytime, anywhere

- Fractional Ownership: Start investing with as little as $1: no need to buy whole ounces

- Instant Transactions: Complete purchases in seconds with real-time pricing

- Secure Storage: Professional vaulting services handle storage and insurance

Blockchain Integration

Blockchain technology has revolutionized gold investing through:

- Transparent Tracking: Every transaction is recorded on an immutable ledger

- Reduced Fraud: Cryptographic security makes counterfeiting nearly impossible

- Global Access: Trade gold-backed tokens across international markets seamlessly

- Lower Costs: Eliminate many traditional middleman fees and storage costs

Mobile-First Investing

Modern gold investing apps provide:

- Real-time price alerts and market data

- Portfolio tracking across multiple precious metals

- Educational resources and market analysis

- Social features to connect with other investors

Using Technology to Your Advantage

The smartest investors aren't choosing between technology and gold: they're using technology to invest in gold more effectively.

AI and machine learning tools can help you:

Optimize Timing: Analyze historical patterns to identify potential buying opportunities, though remember that past performance doesn't guarantee future results.

Monitor Markets: Set up automated alerts for price movements, news events, and market conditions that might affect gold prices.

Portfolio Balance: Use robo-advisors that can automatically rebalance your portfolio to maintain your desired gold allocation.

Research Enhancement: Leverage AI-powered research tools to stay informed about factors affecting precious metals markets.

The key is finding the right balance. Use AI as a tool to enhance your decision-making, but don't become completely dependent on it. Keep gold as your hedge against the very systems you're using to invest.

Market Outlook and Opportunities

The current market environment presents compelling opportunities for gold investors. Central banks purchased a record 1,136 tons of gold in 2022, and many analysts expect this trend to continue as countries diversify away from dollar-dominated reserves.

Price Predictions: Major financial institutions like J.P. Morgan Research expect gold prices to average $3,675 per ounce by Q4 2025, potentially rising toward $4,000 per ounce by Q2 2026.

Several factors are driving this optimism:

- Declining Dollar Dominance: As central banks reduce dollar reserves, gold demand increases

- Digital Currency Growth: Paradoxically, the rise of digital currencies has increased interest in physical gold as a counterbalance

- AI Market Volatility: As AI-driven trading creates more market instability, demand for stable assets grows

- Inflation Concerns: Persistent inflation makes gold's store-of-value properties more attractive

Getting Started with Digital Gold

Ready to add gold to your digital-age portfolio? Here's how to get started:

Step 1: Determine Your Allocation

Most financial advisors recommend 5-10% of your portfolio in precious metals, though this can vary based on your risk tolerance and market conditions.

Step 2: Choose Your Platform

Research digital gold platforms that offer:

- Competitive pricing with transparent fees

- Secure storage options

- Easy buying and selling processes

- Strong customer support

- Regulatory compliance

Step 3: Start Small

Begin with fractional gold purchases to get comfortable with the platform and process. You can always increase your allocation over time.

Step 4: Stay Informed

Monitor market conditions, but avoid emotional decision-making. Gold is a long-term hedge, not a day-trading vehicle.

The Future of Gold in a Digital World

As we look ahead, gold's role as a hedge against digital uncertainty is likely to grow stronger, not weaker. The World Gold Council identifies three potential scenarios for digital gold's evolution:

Pervasive Digital Gold: Enhanced accessibility through digital tools while maintaining gold's traditional safe-haven properties.

DeFi Gold Integration: Tokenized gold generating yields in decentralized finance ecosystems.

Next-Generation Gold Products: Virtual and augmented reality experiences that make gold investing more engaging for younger investors.

The common thread across all scenarios is that gold becomes more accessible and useful while retaining its fundamental value as a hedge against uncertainty.

Take Control of Your Financial Future

In our AI-driven, digitally dependent world, gold offers something that no algorithm can provide: true financial independence and peace of mind. Whether you're a tech worker concerned about industry volatility, a retiree protecting your savings from digital disruption, or a young investor building a balanced portfolio, precious metals deserve a place in your investment strategy.

The best part? You don't have to choose between embracing technology and protecting yourself from it. Modern digital platforms make it easier than ever to own gold while using the very technologies that create the need for such hedges.

Don't wait for the next AI-driven market meltdown or tech sector crash to discover the value of precious metals. Now's the time to act: explore how gold can provide the stability and security your portfolio needs in these uncertain digital times.

Ready to get started? Explore our latest gold investment options and take the first step toward a more balanced, resilient financial future.

Leave a comment